THE Philippine Deposit Insurance Corporation (PDIC), Bangko Sentral ng Pilipinas (BSP) and Department of Finance (DOF) recently issued the Implementing Rules and Regulations (IRR) for Republic Act (R.A.) No. 11840, which amended certain provisions of R.A. No. 3591, or the PDIC Charter. The IRR takes effect 15 days after its publication in the Official Gazette or a newspaper of general circulation.

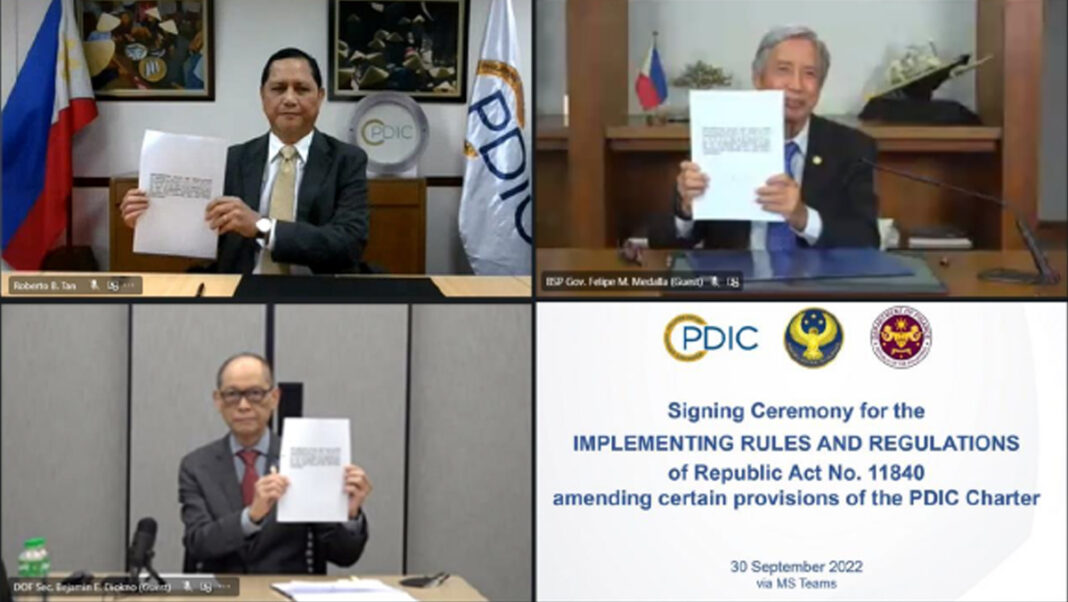

The IRR was signed by PDIC President and CEO Roberto B. Tan, BSP Governor Felipe M. Medalla, and DOF Secretary Benjamin E. Diokno during a virtual ceremony on September 30, 2022. Governor Medalla and Secretary Diokno are the Chairperson and Vice Chairperson, respectively, of the PDIC Board of Directors.

Among the salient provisions of the amended PDIC Charter is the authority granted to the PDIC to adjust the maximum deposit insurance coverage (MDIC) based on inflation or in consideration of other economic indicators as may be deemed appropriate by the PDIC Board without the need for legislation. Under the amended PDIC Charter, the PDIC Board shall review the MDIC, which is currently at P500,000 per depositor, per bank, every three years and adjust it as may be warranted.

Additionally, the state deposit insurer is now mandated to provide insurance cover to Islamic bank products or arrangements classified as deposits by the BSP. Because of the peculiar characteristics of Islamic banking, the amended PDIC Charter likewise authorizes the establishment of separate deposit insurance funds, or insurance arrangements or structures or takaful to cover these types of deposit products.

The PDIC can now also sell closed bank assets to financial institution strategic transfer corporations (FISTCs). Specifically created under the FIST Act, FISTCs can purchase the non-performing assets of financial institutions including loans and real and other properties acquired (ROPA), both of which comprise the biggest chunks of assets held by the PDIC as the statutory liquidator of closed banks.

Under the law, the PDIC is now an attached agency to the BSP for policy and program coordination.

PDIC President Tan expressed optimism that the amended PDIC Charter would redound to better protection for the depositing public.

“Now equipped with the amended Charter and its IRR, the PDIC is more confident in its enhanced capability to protect depositors under any economic conditions. As such, the depositing public can continue feeling secure about entrusting their hard-earned money with banks. Truly, our brand promise to the depositing public, Bank deposit mo, protektado, is made more significant and meaningful with these recent legislative amendments,” the PDIC President said.

Governor Medalla, in welcoming the strengthened synergy between BSP and PDIC, said, “The BSP looks forward to a continued partnership with the PDIC. We will continue to support reforms geared towards the strengthening of the financial sector, with an emphasis on improving regulatory practices and promoting good governance and adherence to global best practices.”

Finance Secretary Diokno also expressed full support to the amended PDIC Charter, citing

enhanced coordination and a more collaborative policy framework within the financial sector.

“Not only does this development further strengthen and expand the financial safety net for depositors and creditors of our banks, it also allows for increased flexibility in the maximum deposit insurance coverage, allowing us to respond more quickly to economic indicators such as inflation, without waiting for legislation,” Secretary Diokno said.

R.A. No. 11840 lapsed into law on June 17, 2022, 30 days after it was presented by Congress to the Office of the President of the Republic of the Philippines. The law took effect on July 20, 2022.| – BNN/pr