By ELYSSA LOPEZ, Philippine Center for Investigative Journalism

Philippine banks are enabling the ‘detour’ in the country’s transition to sustainable and affordable energy.

LIKE many small business owners, Salvador “Aboy” Castro, CEO of renewable energy developer Cleantech, has had his fair share of loan rejections from banks. In 2016, his company managed to establish a solar farm thanks to a partnership with a private equity firm.

“If you weren’t a big player in the energy sector, it was the only way to go (secure funding),” he said.

Castro blamed the lack of regulatory framework in the country for banks’ reluctance to extend loans to renewable energy (RE) developers. But for some stakeholders, the banks’ lack of expertise and understanding of the renewable energy industry had led them to keep the status quo and secure their purses.

“Banks don’t like risks, they like certainty,” said Matt Carpio, head of transaction advisory at the renewable energy-focused consultancy firm Climate Smart Ventures at the sidelines of an event in November 2022.

“Commercial banks, even if you have a power purchase agreement [with a power distributor], they are very conservative. It can still be hard [to secure financing],” he said.

RE risks?

Justin Reginald Nery, a professor at the University of Asia and the Pacific, who published a paper on the sustainable financing practices of banks, explored this phenomenon. Banks have also been averse to financing independent merchant renewable projects, as they supposedly remained “risky,” he found.

“While banks acknowledge the role they play as catalysts in mobilizing capital to finance the transition to renewable energy, merchant plants continue to be considered risky,” Nery and his co-authors said in his paper titled “Does the greening of banks impact the logics of sustainable financing? The case of bank lending to merchant renewable energy (RE) projects in the Philippines.”

The article found that banks considered two factors as risk mitigants for an RE project: offtake agreements and a strong principal sponsor.

The former, the article stated, was used by banks to determine the long-term financial feasibility of the energy company. These agreements were usually in the form of power purchase agreements with a “credible distribution utility company.”

The latter could be in the form of a partner with technical or financial capacity and one that could demonstrate the ability of the RE proponents to fund the equity portion of their project. Independent renewable energy merchants tended to not have both, or have just one of these risk mitigants.

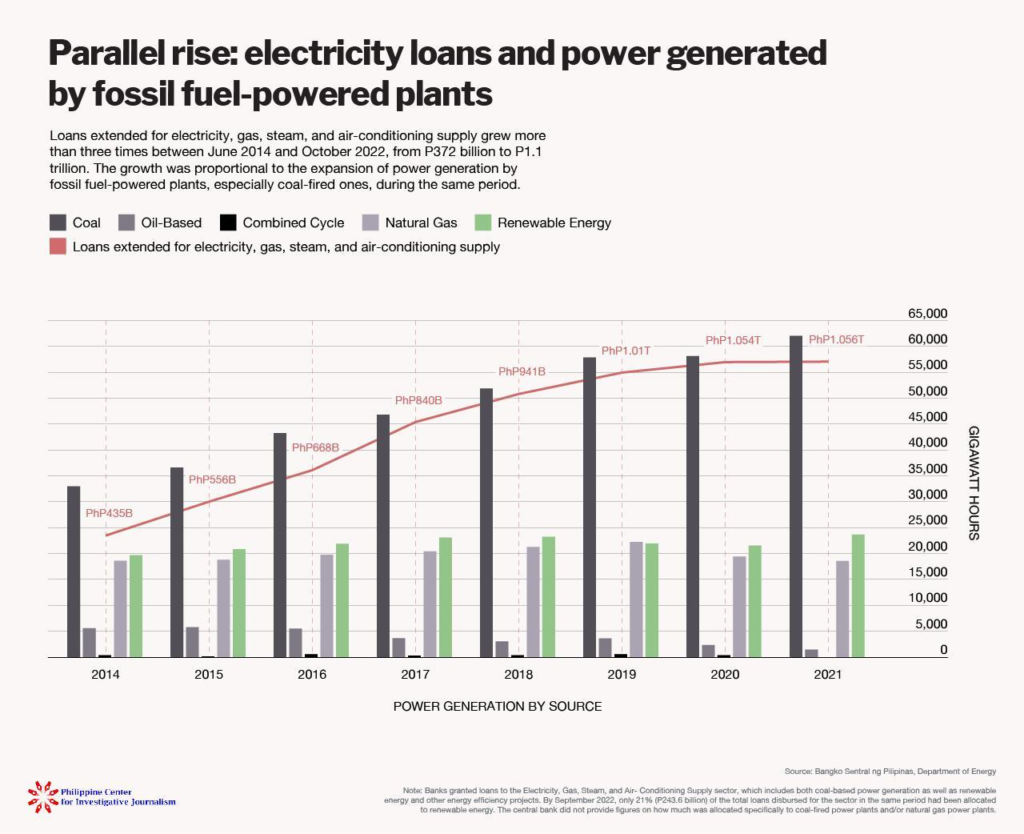

Data from the Bangko Sentral ng Pilipinas (BSP) showed that loans extended for electricity, gas, steam, and air-conditioning supply grew more than three times in the period June 2014 to October 2022, from P372 billion to as much as P1.1 trillion. The growth was proportional to the expansion of power generation of fossil fuel-powered plants, especially coal-fired ones in the country. (See chart)

As of September 2022, according to the BSP, only 21 percent of the total loans disbursed for this sector had been allocated to renewable energy development, equivalent to P243.6 billion. There was no data on loans allocated to coal-fired power plants or natural gas power plants.

For the country’s largest bank and lender, BDO Unibank Inc., “independent merchant-based renewable energy development” remained a “relatively new business model for the financial market in the Philippines.”

“To finance projects with a new business model requires enhanced due diligence on the risks

involved at project level, business model level, and the developer’s creditworthiness

level, among others. Renewable energy projects are not exempt from the same enhanced level of environmental and social risk assessment as any other project,” the company said in response to questions sent by the Philippine Center for Investigative Journalism (PCIJ).

When asked how much exposure the bank had on RE projects, the bank said it would disclose the full details in its 2022 annual report, set to be released by April.

Meanwhile, BPI has been publicly declaring its exposure to energy projects since 2020. At the end of 2021, the bank’s exposure to coal and gas stood at 39% and 13% respectively, with the rest dedicated to renewable energy projects. As of the third quarter of 2022, renewable energy projects took up 50.5% of its energy loan portfolio.

Coal-fired and natural gas power plants are more expensive to build and operate compared with RE plants. The latter requires less capital for operations because fuel is not needed to run them.

A 2021 study by the Sustainable Finance Programme at Oxford University in the United Kingdom suggested that banks enjoyed higher loan spreads when financing coal-fired power plants and natural gas power plants, compared with RE plants.

A loan spread is the difference between the lending and borrowing rates of banks. The spread is a key determinant of a bank’s profitability as a higher differential means higher income.

The Oxford study detailed how financing costs across different energy technologies and markets changed from 2000 to 2020. To do so, researchers analyzed loan data for 2,072 energy deals in 118 countries, including the Philippines, during the said period.

The study found that the loan spread for fossil fuel power generation rose by 16% globally when comparing the 2007 to 2010 and the 2017 to 2020 periods. The RE loan spread decreased by 4%.

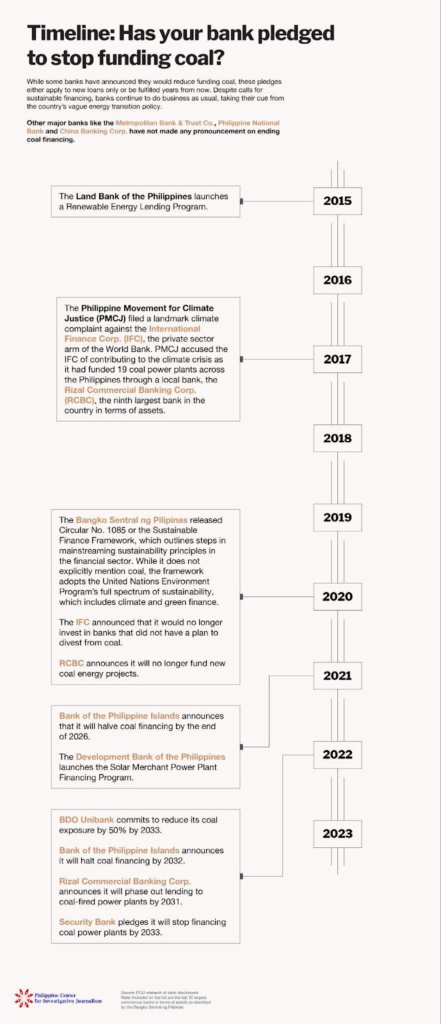

Only three banks in the Philippines – RCBC, Bank of the Philippine Islands (BPI), and Security Bank – have publicly stated they would no longer finance new coal projects. BDO only committed to halving its exposure to coal projects.

BSP’s Circular 1085

In April 2020, the Bangko Sentral Pilipinas (BSP) took a proactive stance to somehow move the needle for banks in terms of financing more climate-friendly projects. This was in contrast to the Duterte government’s limited policy initiatives on climate change mitigation.

The BSP specifically forced banks to embed sustainable financing principles into their operations, risk management frameworks, and training of their board members. By April 2023, banks are expected to have embedded the provisions of the circular in their practices.

There were no incentives however for banks to invest in more climate-change mitigating projects, including financing projects that will hasten the energy transition. Banks have also been slow in following through on the requirements set out by the circular.

For example, banks must have presented to the BSP board-approved strategies and policies integrating sustainability principles into their corporate governance and risk management frameworks and operations, six months after the framework’s effectivity or by November 2020. As of the end of 2022, not all banks have submitted transition plans to the Central Bank.

“We also have a tiny fraction of small banks that intend to prioritize strengthening their respective financial conditions first before adopting the framework,” the BSP said in an email to PCIJ.

According to the regulator, a number of factors kept banks from complying with the circular. These include the lack of technical knowledge to craft and implement sustainability principles, difficulty in identifying and collecting relevant data that may help them measure environmental and social risk factors, and the cost of investment in such efforts.

The BSP did not say if it would impose penalties on banks that did not comply with Circular 1085. The circular does mention any penalty either.

Banks underwrite bonds for coal projects

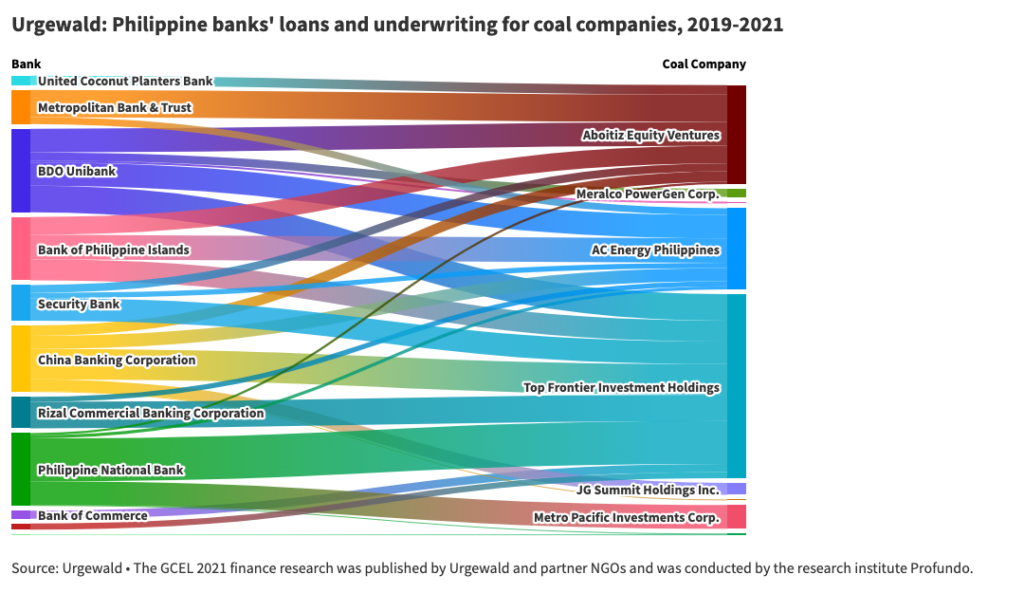

Banks have also continued to finance coal plants by underwriting and selling bonds, according to the Withdraw From Coal (WFC) 2022 report.

“Loans are mostly for assets and projects… But bonds can be more inclusive, or a bigger umbrella so it could support a pipeline of projects of certain clients, and that may include those brown assets,” said Marlon Apanada, a green finance specialist and the Southeast Asia engagement lead at the World Resources Institute.

The WFC 2022 report found that Aboitiz Power, the country’s second-largest power generator, issued four bonds to refinance or redeem bonds that financed two coal projects: GNPower Dinginin and GNPower Mariveles. And the power company tapped the underwriting services of six banks for the bond sale.

Since the report’s publication in May 2022, other coal companies have also raised money by issuing bonds.

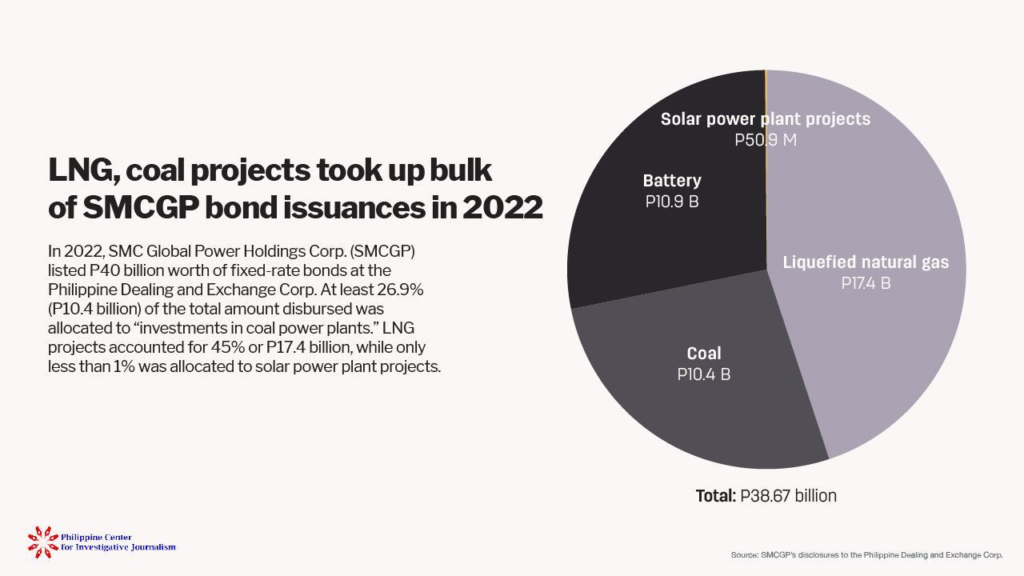

In July 2022, SMC Global Power Holdings Corp. executed the country’s largest bond issuance after raising P40 billion or about $714 million at the Philippine Dealing and Exchange Corp. (PDEX).

That amount was larger than any of the coal-related financing that SMC Global Power’s biggest shareholder, Top Frontier, ever received from any local bank from 2009 to 2021, according to data from the nonprofit research group Urgewald. Seven of the 20 universal banks in the Philippines participated in the issuance.

Subsidiaries of BDO Unibank and China Bank served as joint issue managers as well as lead underwriters and book runners. The investment subsidiaries of Asia United Bank, the Philippine National Bank, Security Bank, and Philippine Commercial Capital Inc. also served as lead underwriters and book runners.

Bank of Commerce and Eastwest Bank served as selling agents of the bonds.

SMC Global Power highlighted its transition to “cleaner and renewable fuel sources” in a press release after the successful issuance of the bonds. But its disclosures to PDEX revealed that at least 26.9% of the total amount disbursed from the bonds, or about P10.4 billion, had been allocated to “investments in coal power plants.”

Meanwhile, 45% or P17.4 billion was allocated to investments in “LNG projects and related assets.” Only a third of the amount disbursed was allocated to investments in battery storage, and less than 1% was allocated to solar power plant projects.

A number of banks have also started to offer loans to other companies developing LNG projects.

FGP Corp., a subsidiary of First Gen Corp., reported to the Philippine Stock Exchange in 2021 that it had drawn a $308-million, six-year term loan from BPI, BDO, PNB, and Sumitomo Mitsui Banking Corp. Singapore Branch to repay its existing debt and to “pre-fund” projects. The company expects to open an offshore LNG terminal by May 2023.

A PCIJ report has found that LNG projects could potentially delay the country’s full transition to renewable energy. (Read PCIJ related story: “Liquefied natural gas: A dirty, costly detour”).

The World Resources Institute’s Apanada argued that such financing activities were part of banks’ “legacy practices.”

“This just shows that there are certain products still being accessed by entities that are not naturally hard to abate in terms of emissions. And that’s just the reality on the ground,” Apanada said.

“While companies have set net-zero, decarbonization goals, these are all set on a certain timeline… and these (developments) are all part of the energy transition process,” he added.

But for Avril de Torres , executive director of Center for Energy, Ecology, and Development, the organization behind the WFC reports, banks’ financing decisions were “furthering deceptions” of the fossil gas industry. “This means they are enabling the detour from our energy transition,” she said.

New coal loans

In April 2022, RCBC and BPI loaned P13.7 billion to ACEN (Ayala Corp. Energy) to refinance an existing P9.8-billion loan of a wholly owned subsidiary, South Luzon Thermal Energy Corp. (SLTEC). The firm operates a 270-megawatt coal power plant in Calaca, Batangas, one of the most critical power plants in the Luzon grid. It was also the only coal power plant in ACEN’s portfolio.

The loan is supposed to help ACEN shut down the powerplant by 2040, 15 years ahead of its technical life. ACEN said the remaining funds of P3.7 billion would help it invest in renewable energy projects and reach its goal of having a 100% renewable energy portfolio by 2025.

Not everyone is impressed, however.

“What is the basis for the 15 years? If we look at calculations of other organizations, like WWF, their simulation states that decommissioning should have happened before 2020. Hindi ba dapat mas maiksi than 15 years? Is that then something to celebrate?” de Torres of CEED said.

De Torres also said the policies being adopted to fast-track the energy transition would have affected the coal plant’s profitability in the long run, anyway.

“This is an industry that is nearing its death, and when you say, ‘We are shortening its lifespan,’ how do you assure us that given the climate now, it (the coal plant) wasn’t supposed to die a natural death earlier than the 15-year timeline you are proposing?” de Torres added.

PCIJ reached out to ACEN for comment. We have not received a response as of posting time.

This may not be the last of such deals, however.

ACEN adopted the principles of Asian Development Bank (ADB)’s Energy Transition Mechanism (ETM), which was launched at the 26th United Nations Climate Change Conference of the Parties (COP26) in November 2021.

ADB’s ETM aims to utilize a financing scheme, this time, with the involvement of the public and private sectors, to incentivize the decommissioning of coal plants earlier in their lifespans and invest in renewable energy instead. The Philippines and Indonesia are pilot-testing the new mechanism.

While the terms of the mechanism have yet to be finalized, the project has already drawn flak from civil society organizations worldwide, including those from the Philippines. In a statement, the NGO Forum on ADB said the mechanism would “absolve” coal companies from “internalising the negative externalities they create” as it would be a form of “buying out” such firms.

In a 17-page report, the Institute for Energy Economics and Financial Analysis (IEEFA) also warned against potential issues posed by the ADB’s initiative on the country’s energy transition process.

“From a bankers’ perspective, the guarantee of 10 to 15 years of additional operation [of a coal = plant]—regardless of other market developments—seems justified as a way to deliver traditional investment returns,” the report said. “However, what is overlooked is that any decision to guarantee a full economic life to a high-carbon emissions facility works against the goal of creating focused incentives for rapid transition.”

BDO has expressed interest in taking part in the initiative. In its board-approved energy transition finance (ETF) statement, BDO said it only committed to reducing its coal exposure by 50% by 2033, and that it would not exceed 2% of its total loan portfolio by the same year.

“New coal exposure refers to exposure to new capacity, while coal exposure refers to the term loans and does not include short-term working capital,” the statement read.

In a private forum organized by EcoBusiness, lawyer Federico Tancongco, senior vice president and head of BDO’s compliance group, clarified that “short-term working capital” would help their customers “transition them to new technologies, and renewable energy.”

For now, BDO is not closing its doors on other fossil fuel financing. In an email to PCIJ, the bank said its ETF statement would be updated regularly as it “determines its exposure to other fossil fuels and aligns its investment portfolio to this approach.”

De Torres said these developments showed that banks remained vague on their coal divestment policies. “Kahit na sabihin mo na you are financing an energy transition loan, you are still refinancing a coal project… so how can you say you are really divesting from coal?” she added.

‘Push-pull’ between regulators and companies

The latest BSP regulation indicated a less committed stance toward investments in RE projects.

In February 2022, the BSP released the Philippine Sustainable Finance Roadmap and Guiding Principles, a taxonomy or a classification tool that helps identify the strategies and economic activities the regulator deems necessary to promote sustainable financing in the country.

The 138-page document included detailed guidelines for regulators, government agencies, and the banking sector to help transition to a “low-carbon economy.”

The BSP defined three pillars that will enable this transition: policy, financing, and investment. The regulator mentioned the need for incentives and penalties to mainstream sustainable finance, a database to monitor the progress of the public and private sectors, and creating an environment of transparency.

However, under the “investment” pillar, the BSP defined low-carbon energy as a term that includes “energy efficiency, renewable energy (including hydro and energy from waste), natural gas, and nuclear power.”

And while banks were only “encouraged to explore and consider” the details of the document, de Torres found such details “anachronistic.”

“Natural gas is lower carbon compared to coal, but really, anything you compare to the dirtiest fossil fuel will have lower carbon emissions. So, that’s not a feat. Anything you compare to coal is cleaner because coal is the dirtiest energy,” she added.

PCIJ tried to seek BSP’s wisdom behind the decision to include natural gas as an option for a “low-carbon economy.” It declined to answer the question twice, via email, despite answering other queries.

The European Union’s sustainable finance taxonomy also allowed natural gas projects, albeit with certain conditions. Critics have contested this provision, pointing out that natural gas, a fossil fuel, should not be considered sustainable.

Bea Victorio of Fair Finance Asia said the BSP might only be merely following the lead of more developed countries that have a “more sophisticated [and] sustainable financing system.”

“As civil society, we understand that the transition process does not happen overnight… But the transition certainly should not look like it takes forever. That’s where we draw the line,” she added.

Stronger leadership from the government is needed to encourage sustainable financing and hasten the energy transition, according to stakeholders.

“BSP can really just issue those guidelines. They could set an example transition on how to manage transitions in terms of physical risks, but in so far as directing things [at banks]… that’s kind of blurry. It’s a regulator-regulatee kind of dynamic,” Apanada said.

Victorio said the guidelines needed “buy-in” from the banks. Otherwise, these would remain “suggestions.”

“If you put policies without teeth, they (banks) would rather pay the fine [for example] to skip that. Unfortunately, that’s the sad truth,” Victorio added.

The Agri-Agra Law, for example, originally mandated banks to allocate a quarter of their loan portfolios to the agriculture sector: 10% for agrarian reform beneficiaries and 15% for agricultural activities. Since the implementing rules were enacted in 2011, the banking industry has yet to meet the threshold. The law was relaxed this year to give banks greater flexibility in terms of the range of qualified projects and customers.

Nery of the University of Asia and the Pacific, who published a paper on the sustainable financing practices of banks, echoed this finding. “As for-profit banks, they would rather pay such penalties instead of risking losing money,” he said.

Carpio of Climate Smart Ventures admitted that the framework could help start conversations within banks to open their coffers for sustainable projects. “But it’s not a silver bullet,” he said.

He added commercial and smaller rural banks would have to develop a “certain level of sophistication” to start understanding the risks involved in RE projects, especially small ones like solar rooftops.

BPI for example said it had managed to fund 100 RE projects of small businesses nationwide, thanks to technical consultations with the experts of the International Finance Corp. (IFC), a World Bank unit.

Under a sustainable energy finance project from 2008 to 2019, the IFC assisted BPI in ensuring the technical feasibility and financial viability of smaller RE projects.

While there are efforts in the public and private sectors to enable the energy transition process, gaps remain.

“The financial sector and the regulators… do not really want to influence the energy policy. The DOE could declare its clean energy ambitions, the BSP could issue the sustainable finance framework and the private sector can comply… but the bridge to make things work on both sides, wala yun e (there’s none),” Apanada said.

Victorio said there was a “push and pull” between the public and private sectors.

“Governments are very cautious that they will stunt growth, while financial institutions… see the lack of regulation to not move towards faster transition. There has to be real cooperation there.” –With research by Martha Teodoro, PCIJ, March 2023