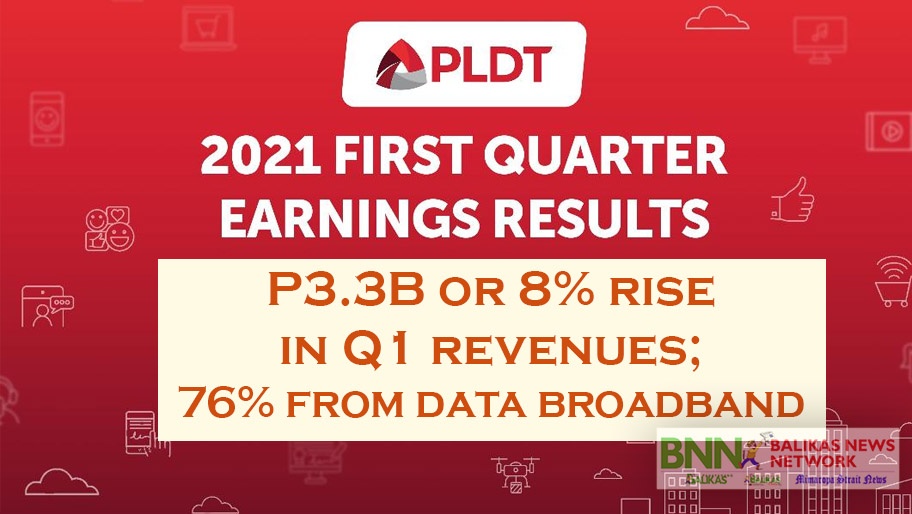

MANILA, Philippines – FORGING ahead with delivering superior customer experience through a sustained network build out despite COVID-19 mobility restrictions, the Philippines’ largest integrated telecommunications company PLDT Inc. (PLDT) (PSE: TEL) (NYSE: PHI) grew Consolidated Service Revenues (net of interconnection costs) by 8%, or P3.3 billion, to P44.8 billion in the first quarter of 2021, led by data/broadband which grew by 15% to P33.9 billion.

Consolidated EBITDA hit an all-time high, growing 7% year-on-year to Php 23.3 billion, excluding MRP (Manpower Reduction Program) expenses, driven by higher service revenues. EBITDA margin was at 51% in the first quarter of 2021.

Telco Core Income (which excludes the impact of asset sales and Voyager Innovations) climbed 9% or Php 0.6 billion to Php 7.5 billion.

Despite a two-week reimposition of Enhanced Community Quarantine (ECQ) in the National Capital Region Plus (NCR+) during the first quarter, PLDT and Smart stores in NCR+ continued to serve customers with skeleton forces, while online channel usage saw a fivefold surge, as customers transacted digitally. Moreover, the company went ahead with installation and repair activities through the lockdown. The ECQ has since been eased to Modified ECQ from the second week of April.

“We have kept our business running, not just to meet the minimum needed by customers or required by regulation but to raise our operating efficiencies and our customer experience to the exceptional standards necessitated by the times,” said Manuel V. Pangilinan, Chairman, President and Chief Executive Officer of PLDT. “We are here not to merely survive in this desolation, but to thrive as we improve the lives and welfare of our customers,” he added.

Consolidated Net Debt as of the first quarter 2021 amounted to US$3,895 million whilst net-debt-to-EBITDA stood at 2.09x. Gross Debt was at US$4,590 million, with maturities well spread out. Only 18% of Gross Debt was denominated in US dollars and 6% unhedged, taking into account hedges and available US dollar cash allocated for debt.

PLDT’s credit ratings from Moody’s and S&P Global remained at investment grade.|