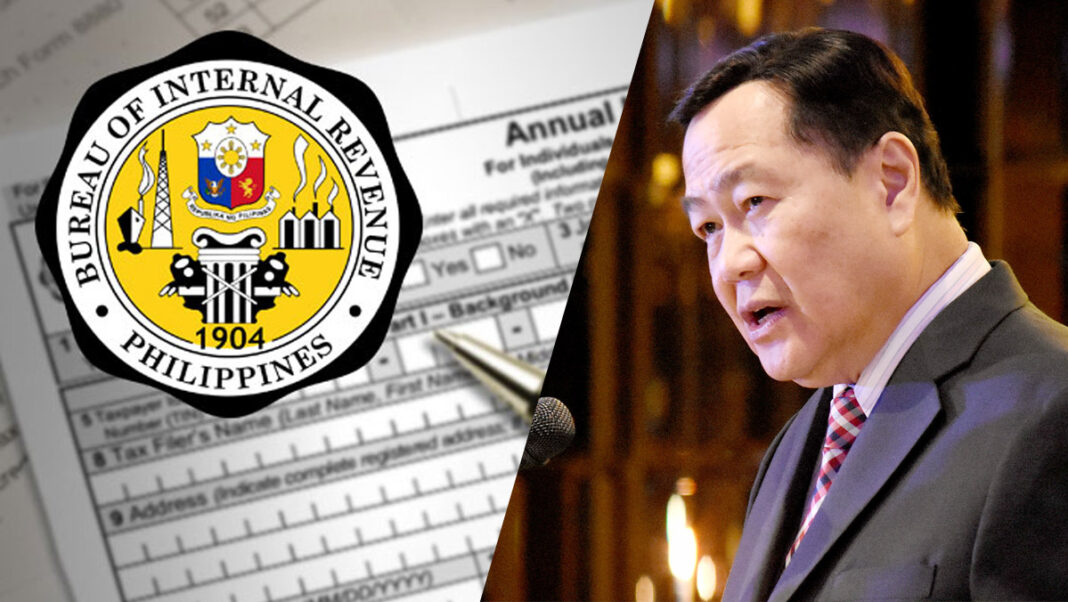

BINASAG ng mga regional director at mga district official ng Bureau of Internal Revenue (BIR) sa buong bansa ang kanilang katahimikan at ibinunyag na ang mga tagapagmana at administrador ng estate ni dating Pangulong Ferdinand Marcos Sr. ay hindi pwedeng papanagutin sa P203 bilyong estate tax assessment.

Kinontra ng mga opisyal ang pahayag nina dating Supreme Court Justice Antonio Carpio at presidential wannabes Isko Domagoso, Manny Pacquiao, Leni Robredo at iba pa, kasabay ng paliwanag na ang estate tax ay ipinapataw sa real at personal property ng namatay na tao at hindi sa mga ari-arian ng kanyang mga kamag-anak.

Matatandaan na iginigiit nina Carpio at iba pa na si presidential frontrunner Ferdinand ‘Bongbong’ Marcos Jr. ay nararapat panagutin sa hindi pagbabayad ng P203-B estate tax, na itinaon ngayong papalapit ang halalan sa Mayo 9.

“I can’t recall of any individual being sent to jail for non-payment of the said tax,” ayon sa isa sa regional director sa panayam ng Manila Bulletin.

Lumalabas na kinakatigan ito ng Korte Suprema. Sa isang desisyon, sinasabi ng katas-taasang hukuman (Marcos II v. Court of Appeals, G.R. No. 120880; June 5, 1997, 339 PHIL 253-275) na ang pagkakautang sa estate tax ay pananagutan ng estate at hindi ng tagapag-mana o administrador ng nasabing ari-arian ng isang pumanaw.

“In the case of notices of levy issued to satisfy the delinquent estate tax, the delinquent taxpayer is the Estate of the decedent, and not necessarily and exclusively, the petitioner as heir of the deceased. In the same vein, in the matter of income tax delinquency of the late president and his spouse, petitioner is not the taxpayer liable,” pahayag ng Korte Suprema.

Samantala, ipinaliwanag pa ng opisyal ng BIR na ang tamang gawin sa ilalim ng Tax Code at revenue regulations ay kumpiskahin at ibenta sa public auction ang mga ari-arian ng namatay para ma-settle ang pagkakautang nito, kung meron man.

“That is what we have been doing for years since the death of the former strong man, but the problem nobody was interested in buying them,” dagdag ng opisyal.

Tila sinagot din ng mga opisyal ang mga batikos sa kanila na wala silang ginagawa ukol sa naturang isyu.

Idinagdag pa nila na noong namatay si Marcos noong 1989, inayos ng mga revenue examiner ang kanyang tax estate na umabot sa P23 bilyon.

Tumaas ang deficiency tax nito sa mahigit P203 bilyon dahil sa one-time 50 percent surcharge at 20 porsyentong taunang interest.

“It’s not a coincidence that rivals of presidential frontrunner Bongbong Marcos are raising this matter in unison a few weeks before the elections, sadly this is all about politics,” ayon sa isang opisyal

Kamakailan ay binatikos din ng kampo ni Marcos ang pagpapalabas ng naturang isyu na bahagi pa rin ng maruming pulitika ng kanyang mga kalaban.

“Our rivals are misdirecting everyone by claiming that the case has attained finality when the truth of the matter is, it is still pending in court and the ownership of the properties in litigation has yet to be settled,” ayon kay Atty. Vic Rodriguez, tagapagsalita at chief of staff ni Marcos.

“That being the case, the fair and just tax base to be used in computing the estate tax cannot yet be established with certainty,” dagdag ni Rodriguez.|